…And now the “96 percent”

Yesterday’s post ended with an allusion to the “Hidden Welfare State” and the world of tax expenditures. Households across all income categories are the beneficiaries of government assistance programs, and the oft-reported 49 percent who receive some type of government benefit is true only in a narrow sense. So, in the end, how many of us actually receive government benefits?

A great op-ed in the New York Times by political scientists Suzanne Mettler and John Sides gives us some insight into this question. Once you account for the whole range of targeted government benefits, including the traditional “social safety net” programs plus all of the big tax expenditure programs, the 49 percent becomes 96 percent. As it turns out, we are all “lucky duckies” (to re-purpose a term coined by the Wall Street Journal to describe those who don’t pay federal income tax).

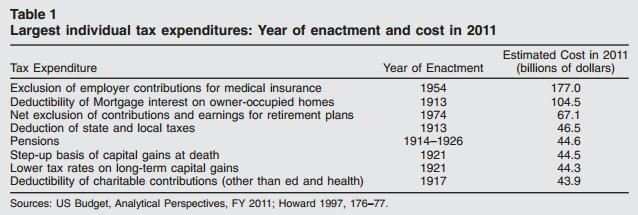

Benefits provided through tax expenditures — deductions and breaks for mortgage interest, child care, employer-provided health insurance, retirement contributions, and more — and those provided through direct expenditures — Social Security, unemployment insurance, TANF, etc. — are alike in important respects. They both provide direct benefits to households, they both impact the federal budget in the same way, and they both “redistribute” wealth.

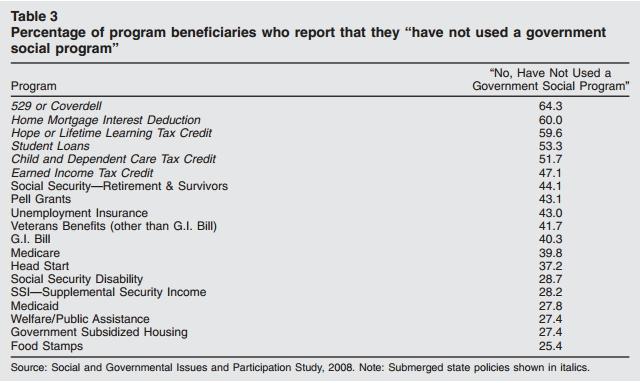

The biggest difference between the two types of government assistance is perception. Christopher Howard called it the Hidden Welfare State for a reason. First, tax expenditures are inherently less visible as they are part of the complex web of rules that is our U.S. tax system. Instead of receiving a check in the mail, households often just don’t pay as much in taxes as they would if a particular tax expenditure program didn’t exist. If households do receive a tax refund in the mail, it is sometimes difficult for many to know exactly what tax expenditure programs contributed to that refund. Second, as opposed to direct expenditures (the traditional “social safety net”), tax expenditures more often benefit the middle-class and the wealthy, much harder targets to demonize as freeloaders or label as “lucky duckies.” Below is a table created by Mettler in a 2010 article on the percentage of government assistance beneficiaries who say they do not receive benefits. Not surprisingly, all of the tax expenditures listed in the table are also the least recognized by recipients:

This difference in perception between the traditional social safety net and tax expenditures matters. Case in point: Romney’s recent comments about the “47 percent.” The hidden nature of tax expenditures, combined with the visible nature of many direct expenditure programs that target the poor, allows the public to conflate government benefits with “welfare,” thereby missing huge chunks of government support. It’s what allows the public to construe beneficiaries of direct expenditure programs negatively (the “moochers”) and beneficiaries of hidden programs positively (the “producers”).

Social tax expenditures constitute a big government expense — Mettler estimates about 7.4% of GDP, compared to 5% of GDP for Social Security, the most expensive direct expenditure program.

As Mettler has aptly argued:

“In an age of rising economic inequality, our nation has permitted the continuation of these submerged policies that aid primarily the most advantaged Americans and sharply reduce federal revenues, making programs that could assist low to moderate income people far more difficult to afford.”

The fact of the matter is that through the course of our lifetimes we are all producers and moochers. We both pay taxes at some point and receive the benefits of those taxes at some point. We, as a public, may well disagree about how much to prioritize various government benefits in an age of scarcity (for instance, is it absolute necessary that we continue to pay for mortgage interest tax deductions for McMansions while we debate cutting food stamp benefits?), but we must start by acknowledging the fuller existence of government benefits and the near-universal reliance of the public on them.

–

Dustin Cable is a Policy Associate at the University of Virginia’s Weldon Cooper Center for Public Service where he conducts research on topics that lie at the intersection of demographics, politics, and public policy.

Michele Claibourn is a Research Associate at the University of Virginia’s Weldon Cooper Center for Public Service where she specializes in statistical modeling and civic engagement. She’s the author of Presidential Campaigns and Presidential Accountability.