“47 percent” and other statistics

Last week’s release of the now infamous Mother Jones video of Romney’s comments on the “47 percent” of Americans who don’t pay income taxes has everyone talking about the U.S. tax system. Despite this election cycle’s relative dearth of substantive, detailed policy discourse, the campaigns and the media have indeed provided the public with a lot of useful information on the way taxes work in this country. The terms “Capital Gains” and “carried interest” have entered the common vernacular and it seems that everyone now knows about the “Buffet Rule” and the tax rates for certain types of income.

If any good has come out of Romney’s comments on the “47 percent,” it is that the public now has a better understanding of those folks who have been labeled by some on the right as “lucky duckies.” The left has been quick to argue that these lucky duckies are actually not so lucky; and by now many of us have seen or heard the statistics complied by the non-partisan Tax Policy Center:

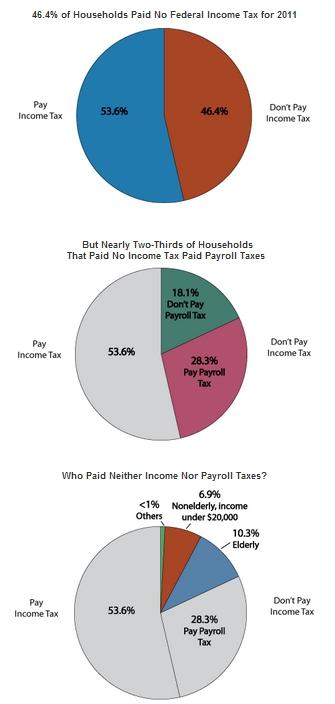

- 46.4 percent of households do not pay federal income tax.

- Of those 46.4 percent, nearly two-thirds do pay federal payroll taxes (which pays for Social Security, Medicare, Disability Insurance, and a few other programs).

- Those who don’t pay federal income or payroll taxes are either the elderly (who get most of their income from social security, which, for most of these people, is not taxed) or low income households who don’t have much or any money to pay toward taxes in the first place.

- A small percentage of very wealthy households also manage to avoid federal income and payroll taxes through various tax loopholes.

The more inquisitive among us might have also looked a little deeper. They may have come across statistics from the Citizens for Tax Justice, which suggest that our focus on federal taxes is a bit narrow and does not tell the full story. As it turns out, when state and local taxes are factored into the picture those lucky duckies seem to be paying nearly as much in taxes as their affluent counterparts. The regressive nature of state and local taxes washes out much of the progressiveness of the federal tax system. Even the bottom 20 percent of earners pay 17.4 percent of their income in taxes.

Romney’s comments also seem to conflate two very different populations. The “47 percent” who don’t pay federal income tax is different from the 49 percent who receive some type of government benefit. Many who receive government benefits also pay federal income taxes, and many who don’t pay federal income taxes don’t receive government benefits. The Census Bureau provides the following household breakdowns for this “49 percent: “

| Recipiency status and program | Percent |

| Received benefits from one or more programs | 49.0 |

| Social Security | 16.2 |

| Railroad Retirement | 0.1 |

| Veterans’ compensation | 1.0 |

| Unemployment compensation | 1.7 |

| Workers’ compensation | 0.2 |

| Veterans’ educational assistance | — |

| Medicare | 14.9 |

| One or more means-tested programs | 35.1 |

| Public or subsidized rental housing | 4.5 |

| Federal Supplemental Security Income (SSI) | 6.5 |

| Food stamps | 15.8 |

| Temporary Assistance for Needy Families (TANF) | 2.0 |

| Other cash assistance | 1.8 |

| Women, Infants, and Children (WIC) | 7.5 |

| Medicaid | 26.4 |

| *totals do not add to 100% due to participation in multiple programs |

Again, if you are about to write off this 49 percent of the population as lucky freeloaders, be sure to keep a few things in mind. First, you would be writing off all of those people who paid into the large social insurance programs over their lifetimes and are now collecting on those contributions. This includes grandma and grandpa receiving social security and medicare, your brother who was recently laid-off from his job and is collecting unemployment benefits, or your neighbor who served in Iraq and is receiving veteran disability benefits. Secondly, much of the participation in means-tested programs, like Food Stamps, waxes and wanes with the boom and bust cycles of the broader economy. Since the current economic recovery has been stubbornly slow, participation rates in these programs have been high, but this by no means suggests that these people will stay on program rolls. Participation in most means-tested programs (with exception to Medicaid) is expected to go down if and when the economy improves, as it has done in past recoveries.

Statistics on household receipt of government benefits can be misleading when put into certain contexts. As soon as people hear that “49 percent of households receive government benefits” they tend think only of means-tested programs, like TANF or Medicaid, and not some of the largest parts of the social safety net (i.e. Social Security and Medicare). Pundits and politicians use this misunderstanding to their advantage when trying to convey that dependence on government assistance is too high.

On the other hand, the statistics gathered by the Census Bureau in the above table can lead people to believe that dependence on government assistance is lower than it truly is. The Census Bureau’s statistics don’t include the myriad array of programs built into the U.S. tax code, called “tax expenditures,” that give credits and tax breaks. In budgetary terms, these tax expenditures behave just like traditional social safety net programs and also “redistribute” wealth. However, most tax expenditures tend to target middle and high-income households. The deductions and breaks on mortgage interest, charitable donations, inheritances, or corporate health insurance and pensions are some of the largest tax expenditures. Political scientist Christopher Howard went so far as to say that these tax expenditures constituted a massive “Hidden Welfare State” for the well-off because they are so rarely discussed.

Even here, however, this election year has offered the public a chance to explore the issue of tax reform and each candidate’s position on popular tax expenditures. A big part of Romney’s campaign message is on a tax reform plan that lowers rates by eliminating many tax breaks and loopholes (even if he does not go into detail over which tax expenditures he would like to eliminate).