Why Virginia Needs a New Poverty Measure

How many of us are poor?

Answering that question is not as easy as one may think. Yes, we do have an official poverty statistic that is produced by the U.S. Census Bureau, but nobody likes it. Many on the Left think it is too low, failing to capture the full array of expenses that families face. Folks on the Right think it is too high because it does not account for the effects of many anti-poverty programs and tax credits on family budgets.

Even the Census Bureau is not entirely satisfied with current poverty statistics. As they continue to produce the official measure, they have recently been releasing alternative statistics through the “Supplemental Poverty Measure” (SPM) program. These new numbers reflect a more nuanced look into poverty, and are widely believed by researchers and the media to better capture the actual financial circumstances of American families.

But the SPM has its limitations. Primary among them is that the new measure is designed for the national level. State estimates are only available as three-year averages, and local-level estimates are not available at all.

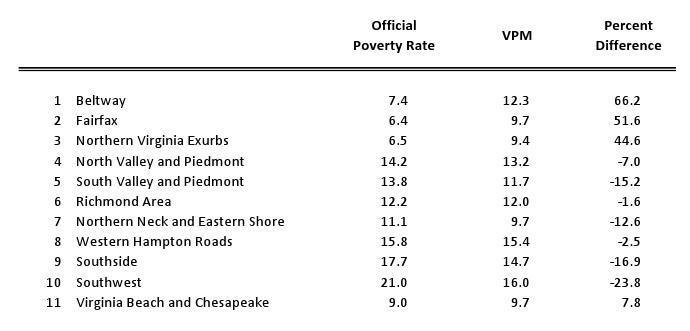

This is unfortunate for a state like Virginia, which has wide regional inequalities in terms of economics, education, and even basic demographics. Because of this, official poverty statistics don’t make sense in Virginia. A one-size-fits-all measure that defines poverty in Northern Virginia the same as it does in coal country does not work and belies our commonsense understanding of the actual resources and costs families face across regions. A better method is needed.

Today, the Cooper Center is releasing its work on a new “Virginia Poverty Measure” (VPM) that will provide SPM-like estimates for Virginia and its local regions.

These VPM estimates represent a dramatic improvement upon official statistics including adjustments made for:

- Regional differences in the cost of living. The VPM accounts for regional differences in the cost of major goods and services such as housing, food, and health care. As expected, costs vary tremendously across regions in Virginia, and VPM poverty thresholds are adjusted accordingly.

- Taxes and Credits. Payroll taxes and federal and state income taxes are subtracted from family resources in the VPM. Also, the VPM accounts for important refundable tax credits such as the federal Earned Income Tax Credit.

- Necessary medical expenses. Health care is a growing part of family budgets, and the VPM accounts for these necessary expenses by adding them to the poverty thresholds according to family size, age of household members, and health insurance status.

The full details of the VPM and its major findings are made available in the VPM report, but here are a few of the major highlights:

- Although Northern Virginia counties and cities enjoy some of the highest median incomes in the nation, the VPM shows that the extent of economic deprivation in the region is significantly greater than what official poverty statistics suggest. For example, by capturing the impact of the region’s high cost of housing, the VPM finds many more Northern Virginia residents in or near poverty, particularly those living inside the Beltway.

- The VPM poverty rate for children is dramatically lower than the official rate. Official statistics do not account for the impact of many government programs targeted favorably towards families with young children. By including these tax code provisions and in-kind benefits, the VPM recognizes the full range of resources available for families with young children.

- By including calculations for taxes and adjustments for costs of living, the VPM classifies a greater number of people as “near poor.” However, by including more government programs and subsidies for the poor, the VPM finds fewer Virginians in “deep poverty.”

These results underscore why Virginia needs an alternative way to measure poverty, and the new VPM is a significant step forward towards better understanding the actual population in economic distress in the commonwealth.