Emission Market Design: California Allowances

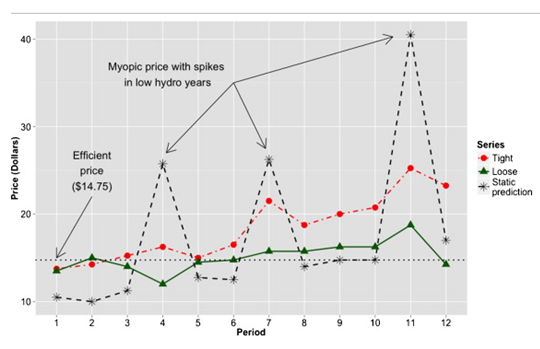

This paper uses economic experiments to test the effects of some novel features of California's new controls on greenhouse gas emissions. The California cap-and-trade scheme imposes limits on allowance ownership, uses a tiered price containment reserve sale, and settles allowance auctions based on the lowest accepted bid. We examine the effects of these features on market liquidity, efficiency, and price variability. We find that tight holding limits substantially reduce banking, which, in turn reduces market liquidity. This limits the ability of traders to smooth prices over time, resulting in lower efficiency and higher price variability. The imposition of holding limits in the allowance market may increase the likelihood of the market manipulation that they were intended to prevent.

Future research should address whether there are less costly mechanisms for limiting market power of large emitters. Notably, the two very different approaches to releasing the price containment reserve into the market do not have measurably different effects on key measures of market performance: liquidity, price variability, and efficiency. The different patterns of reserve use that arise from the two mechanisms justify increasing attention to the design of price collar mechanisms. Under different conditions, such as tighter caps or larger reserves, differences between them might emerge, making this an interesting area for further research.

For the full study, download the file below.