The Effects of Seemingly Nonbinding Price Floors

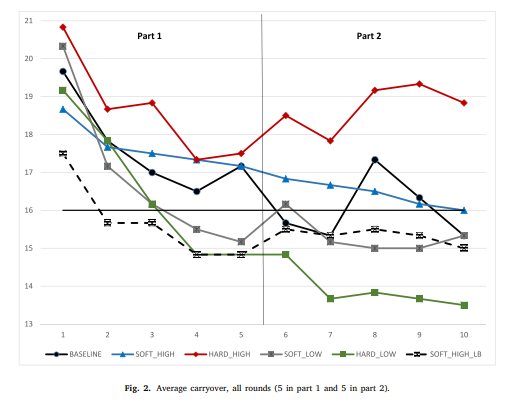

Price floors are common policies in markets for storable goods such as commodities, bankable emissions permits, and currencies. Hard price floors prevent the price from falling below the floor; soft floors allow the market price to fall below the floor. Theory predicts that asset prices will respond to price floors even in a set of circumstances where the floor seems nonbinding. Most of our experimental findings are consistent with theoretical predictions: a seemingly nonbinding floor can cause the price to jump up; the jump is higher with a hard floor than a soft one; and when the floor is so low that the theory predicts no effect, none is observed. In contrast to theoretical predictions, however, the soft floor fails to increase the market price in our experiment.

For our paper, we constructed a two-period model to show why the price of storable goods (commodities, bankable emissions permits, or currencies) may be determined by a price floor even though the price floor lies strictly below that price. Similarly, a price ceiling may exert a downward force on the price even though the ceiling lies strictly above it. Floors raise the expected future price while ceilings lower the expected future price.

For the full study, download the file below.