The Effects of ‘‘Nonbinding’’ Price Floors

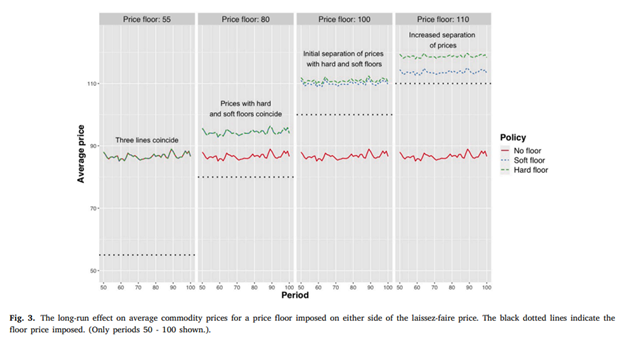

This paper explores the impact of price floors on cap-and-trade programs used to limit emissions of pollutants like CO2. Price floors are a common form of policy intervention to artificially raise prices in certain sectors, with minimum wages in labor markets and set prices in grain markets as common examples. The prevailing understanding is that prices set below the market-clearing price will have no effect and that prices set above the market price will raise the price until the market price equals the price floor. This is accurate in the labor market, but this paper shows that these principles do not hold when applied to storable assets like grains or pollution allowances. In this paper, the authors prove that whether a floor is inserted above or below the laissez-faire price of a storable asset, it may immediately raise the price, leaving it strictly above the floor. Even though the floor is below the equilibrium price, the floor may still influence the price – a phenomenon the authors term “action at a distance.” The paper also shows that a seemingly nonbinding hard floor (when the government is willing to purchase unlimited amounts at the support price) will raise prices by more than a seemingly nonbinding soft floor (when the government is only willing to buy a limited quantity per period at the floor price, meaning the market price can fall below the floor). Conversely, removing a price floor altogether may cause an immediate drop in the price—possibly to a level even lower than the price floor had been.

The paper has several important implications for economic research. First, the paper’s findings should eliminate the unfortunate current practice of analyzing price collars in emissions-trading markets as if they were hard floors when, in fact, they are soft floors. The study’s results also validate observations from disparate fields. The results show that Krugman’s insight regarding foreign exchange markets with hard floors extends to markets for other storable assets and the findings explain previous intuitions that the ‘‘nonbinding’’ soft floor under the permit price in California’s cap-and-trade program is raising its price. Lastly, the results provide a rationale for the observation in the Financial Times (2013) about the influence of the hard floor in China’s rice market.

For the full study, download the file below.